kansas vehicle sales tax estimator

TAX POLICY AND REPORTS OTHER KANSAS DEPARTMENT OF REVENUE ONLINE SERVICES Many of our services are conveniently available online. The make model and year of your vehicle.

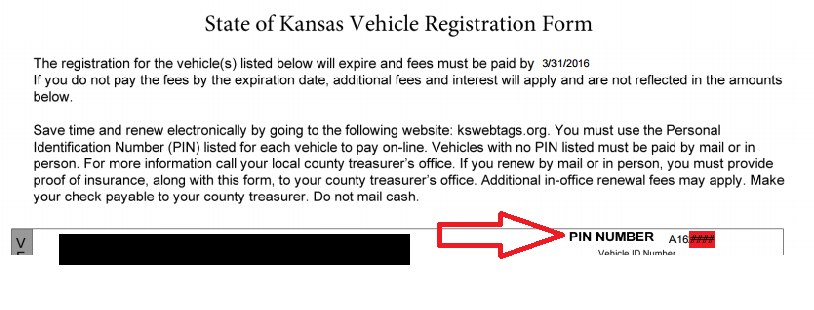

Kansas Department Of Revenue Division Of Vehicles Vehicle Tags Titles And Registration

It currently sits at 65 but when including city and county rates shoppers in certain parts of.

. Kansas Vehicle Sales Tax Estimator. The minimum is 65. The sales tax in Sedgwick County is 75 percent.

Your average tax rate is 1198 and your marginal tax rate is. The sales tax in Sedgwick County is 75. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year.

The information you may need to enter into the tax and tag calculators may include. The sales tax varies greatly by location in kansas with the highest rate. You can use an online calculator from the Kansas Department of Revenue to estimate your total car sales tax based on your location.

The vehicle identification number VIN. Kansas Department of Revenues Division of Vehicles launched KnowTo Drive Online a web-based version of its drivers testing exam powered by Intellectual Technology Inc. The flipside of these fairly low income taxes is a sales tax rate thats a bit on the high side.

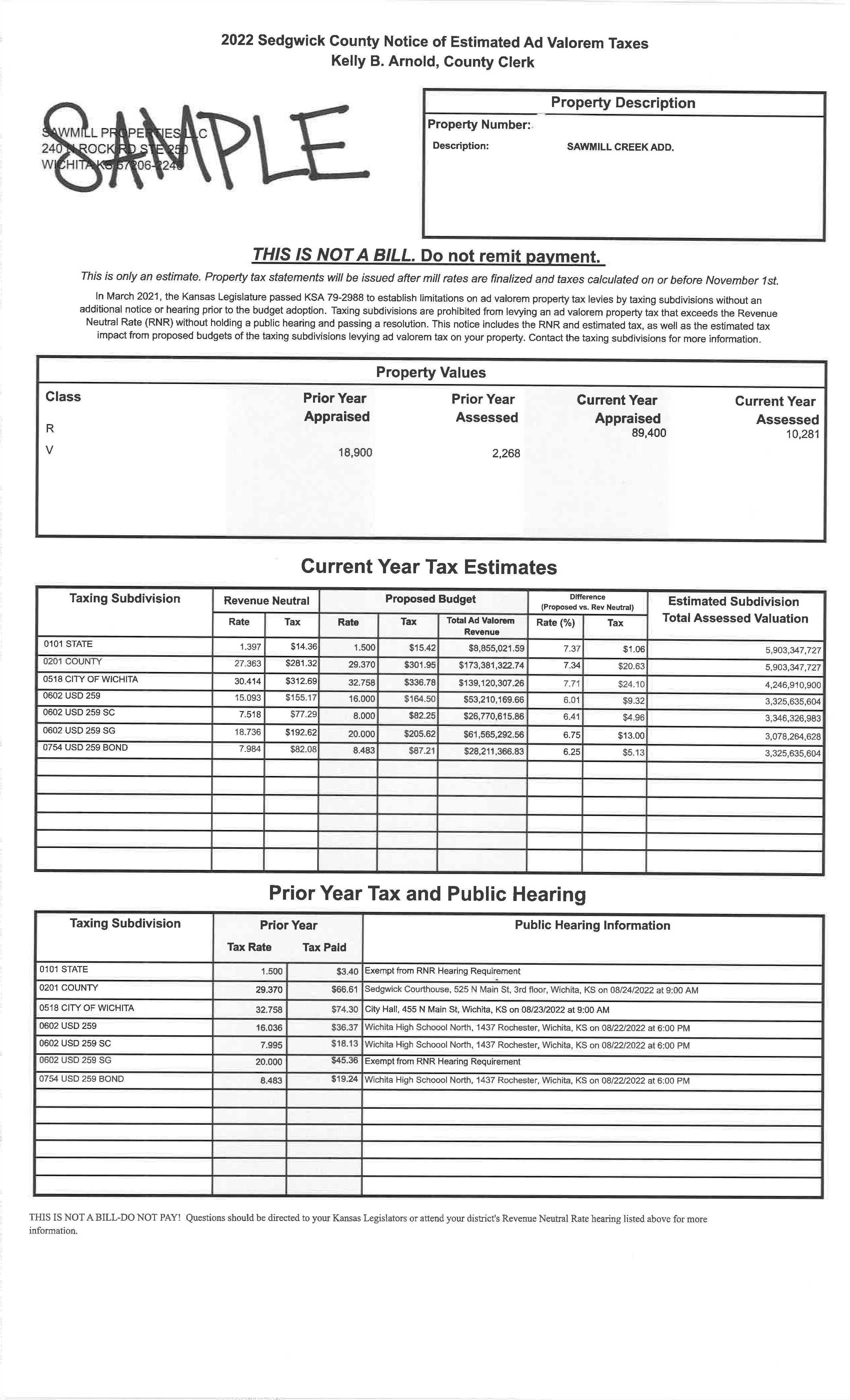

Property Tax Estimator Property Tax Estimator. Kansas Income Tax Calculator 2021 If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. Kansas vehicle sales tax estimator Friday June 3 2022 Edit.

How to Calculate Kansas Sales Tax on a Car. Kansas Vehicle Property Tax Check - Estimates Only. Dealership employees are more in tune to tax rates than most government officials.

Kansas Vehicle Registration Fee Calculator Study. Kansas Vehicle Property Tax Check - Estimates Only. If you dont see the vehicle you want.

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Browse our full inventory online and then come down for a test drive.

Calculate Auto Registration Fees and Property Taxes. Vehicle property tax is due annually. The date that you.

You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. Use the Kansas Department.

Once you have the. Multiply the vehicle price. In many cases you can.

A mileage reading will still be required. Title and Tag Fee is 1050. All you need is your dealerships.

Just enter the five-digit zip code. This means that depending on your location within Kansas the total tax you pay can be significantly higher than the 65 state sales tax. Instructions for Michigan Vehicle Dealers Collecting Sales Tax from Buyers Who Will Register and Title Their Vehicle in Another State.

If you are unsure call any local car dealership and ask for the tax rate.

Treasurer Douglas County Kansas

Used Cars In Kansas For Sale Enterprise Car Sales

Used 2022 Nissan Pathfinder For Sale In Newton Ks With Photos Cargurus

Revenue Neutral Rate Faq Sedgwick County Kansas

Tax Calculator Chanute Ks Official Website

Sales Tax Bonner Springs Ks Official Website

Car Tax By State Usa Manual Car Sales Tax Calculator

Used 2017 Ford Edge For Sale In Kansas Save 7 498 This November Cargurus

Vehicle Registrations And Titling Johnson County Kansas

Wilson County Kansas Motor Vehicle

Top 50 Used Mazda Mazda2 For Sale In Kansas City Mo Cargurus

Kansas 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Tag And Taxes Treasurer S Office Reno County Ks Official Website

Tag And Taxes Treasurer S Office Reno County Ks Official Website

Motor Vehicle Johnson County Kansas