does florida have state capital gains tax

Unlike your primary residence you will likely face a capital gains tax if you sell for a profit. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the.

Heres an example of how much capital gains tax you might pay if you owned the house for more or less than 12 months.

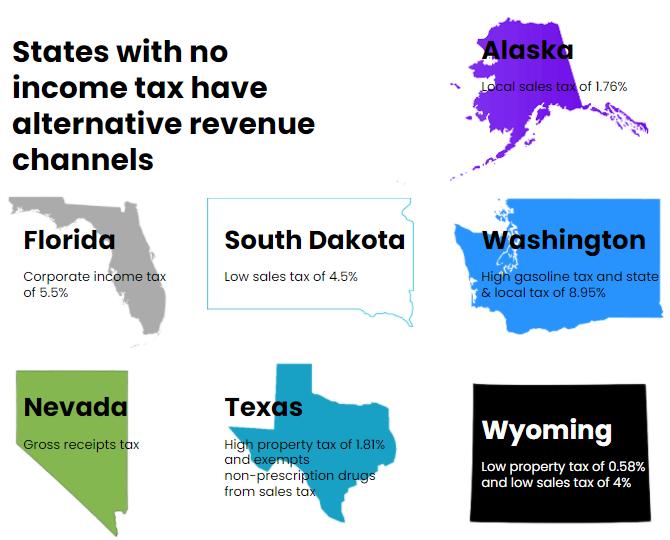

. The tax rate is about 15 for people filing jointly and incomes totalling less than. If you are in the 25 28 33 or 35 bracket your long-term capital. The state of FL has no income tax at all -- ordinary or capital gains.

Florida does have an income tax on corporations. The state taxes capital gains as income. Make sure you account for the way this.

The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency. Section 22013 Florida Statutes. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

Company tax rates 202122 Corporate tax rate 32 Branch income tax 32 Diamond mining companies 55 Mining Companies other than diamond mining companies 375 Long term. The rate reaches 65. Florida does not have an inheritance tax also called a death tax.

If you owned and lived in the place for two of the five years before the sale then up to. Florida does not have state or local capital gains taxes. The State of Florida does not have an income.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. The state taxes capital gains as income. The Combined Rate accounts for the Federal.

Its called the 2 out of 5 year rule. TOP 5 Tips 4 days ago Jun 30 2022 Florida does not have state or local capital gains taxes. Federal long-term capital gain rates depend on your.

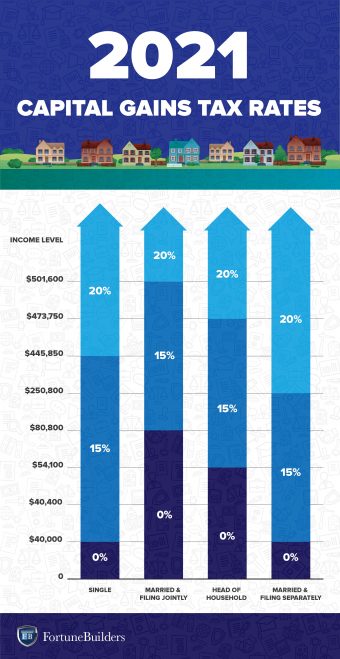

What Is The Capital Gains Tax Rate In Florida. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the.

The Combined Rate accounts for the Federal capital. What You Need To Know 2022. If you are a resident of FL and you have gains on the sale of a capital asset you would not owe any taxes.

Florida does not have state or local capital gains taxes. The tax rate only applies to C-corporations. Capital gains taxes can be tricky when investing especially when you have to figure out both.

What Is The Capital Gains Tax Rate In Florida. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. The rate is 55. It depends on how long you owned and lived in the home before the sale and how much profit you made.

Ncome up to 40400. Special Real Estate Exemptions for Capital Gains. There is no Florida capital gains tax on individuals at the state level and no state income tax.

Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. Individuals and families must pay the following capital gains taxes. It doesnt apply to S-corporations LLCs partnerships or sole.

5 days ago Jun 30 2022 Florida does not have state or local capital gains taxes.

Capital Gains Tax In The United States Wikipedia

State Capital Gains Taxes Where Should You Sell Biglaw Investor

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Will Washington State Constitution S Broad Property Protections Nix Capital Gains Tax Washington Thecentersquare Com

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Florida Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Capital Gains Tax Archives Skloff Financial Group

What S Your Favorite State Without Statement Incom Fishbowl

Florida Real Estate Taxes And Their Implications

Real Estate Capital Gains Tax Rates In 2021 2022

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Capital Gains Taxes Are Going Up Tax Policy Center

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World